8th April 2022

Interview with Dr. Georges Chalhoub, Director of Cash Operations, Bank of Lebanon

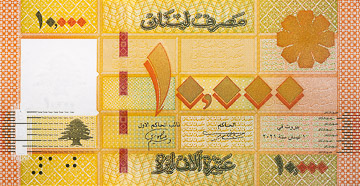

During the Banknote Conference, Washington DC, Crane Currency had a chance to sit down and speak with Dr. Georges Chalhoub, Director of Cash Operations, Bank of Lebanon, to talk about his career at BdL and the recently issued 10,000 LBP banknote.

Q: Can we start with your telling us how many years you´ve been with Bank of Lebanon and the position you hold today?

A: I started in 1996 in the Bank´s IT Dept, before moving over to Treasury in 2007. For five years, I´ve been the Acting Director of Cash Operations. I have a PhD in Information Technology.

Q: How did your formal training in IT impact your career at the Bank?

A: I brought my IT skills to bear on the Bank early on, and it´s propelled my career, especially as the Bank in passionate about and devoted to research and ongoing improvement.

Specifically, I was very active in the Bank´s development of ‘Smart Shelves’ for the inventory of both new and circulated banknotes. To my knowledge, we were among the first central banks to use RFID tagging for our cash boxes. This project was successful in reducing risks associated with human error and security.

The Bank has also performed extensive circulation trials, publishing two reports on the experience. It was on projects such as these that a strong background in information technology was an advantage to the Bank and me personally.

Q: A new series of 10,000 LBP banknotes was issued recently. Can you tell us about the changes?

A: Sure, Principally, the color-shift security thread was replaced with a RAPID® micro-optic security thread. Additionally, the serial numbering was modernized, doing away with the previous fractional numbering. Our analysis suggested that the movement effect of the micro-optic thread was better for human perception. Additionally, we felt that the security afforded by color-changing thread has been reduced since its first inclusion in this banknote. You can find this material in the market now, outside of the banknote industry. Such materials are useful to the counterfeiter in simulating the color-change effect, whereas moving images are, we believe, better for public perception.

Q: What does the Bank look for in its evaluation of new security features?

A: We listen to and meet with the industry. We also conduct our own evaluations. We have a fully equipped laboratory to assess features. We evaluate durability. We consider how difficult it is to remove a feature from the banknote. We also measure more conventional attributes. In addition, we have used focus groups to understand how the public uses and verifies different security features, including how many seconds it takes them to identify real banknotes from counterfeits.

Q: Can you provide a quick review on what you have brought to this conference?

A: My participation on yesterday´s panel was about the impacts COVID brought on the Bank and our Cash Department. In Lebanon, our crises began in 2019 and throughout the COVID period we have faced a series of shocks that have effectively pushed our economy towards being completely cash reliant. I feel that from this perspective, I may be able to share insights helpful to my follow central bankers as well as suppliers.

Q: We understand that a new 5,000 LBP banknote is set to issue soon. Is this something you can comment on?

A: Yes, its issuance is imminent and will conclude the upgrading of the current series.